The True Impact of Covid-19 on UK Power

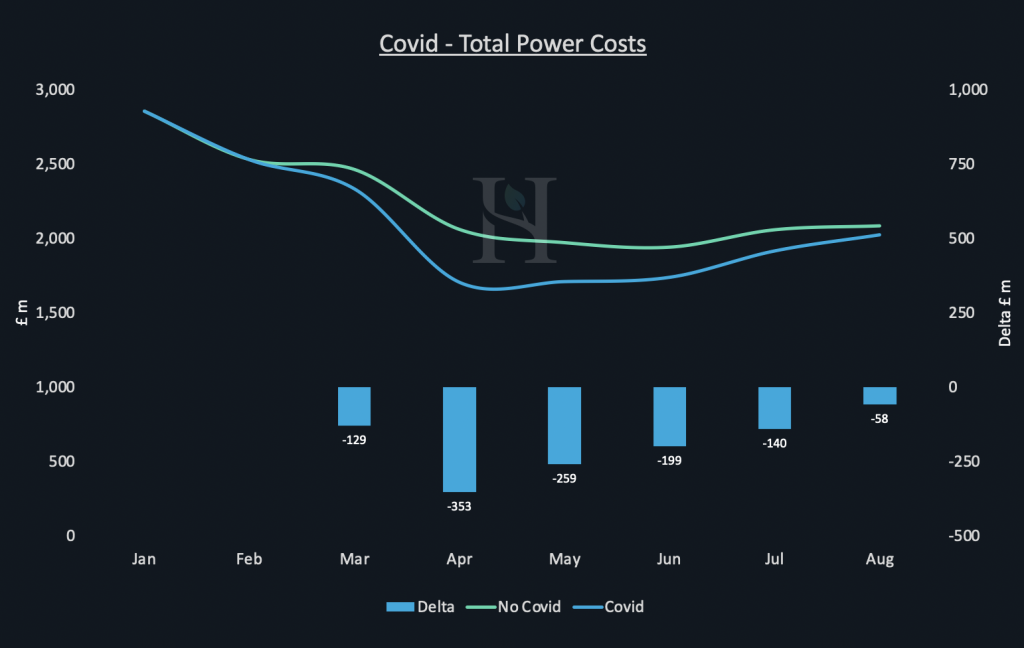

Covid-19 caused a drop in both power prices and demand via the induced lockdown that resulted in a loss of income in the UK Power Industry of £1.1b between March and August, our analysis shows.

Headline Figures

• £1.1b Loss of Income in the UK Power Industry

• £488m Loss of Income from Wholesale Power Costs

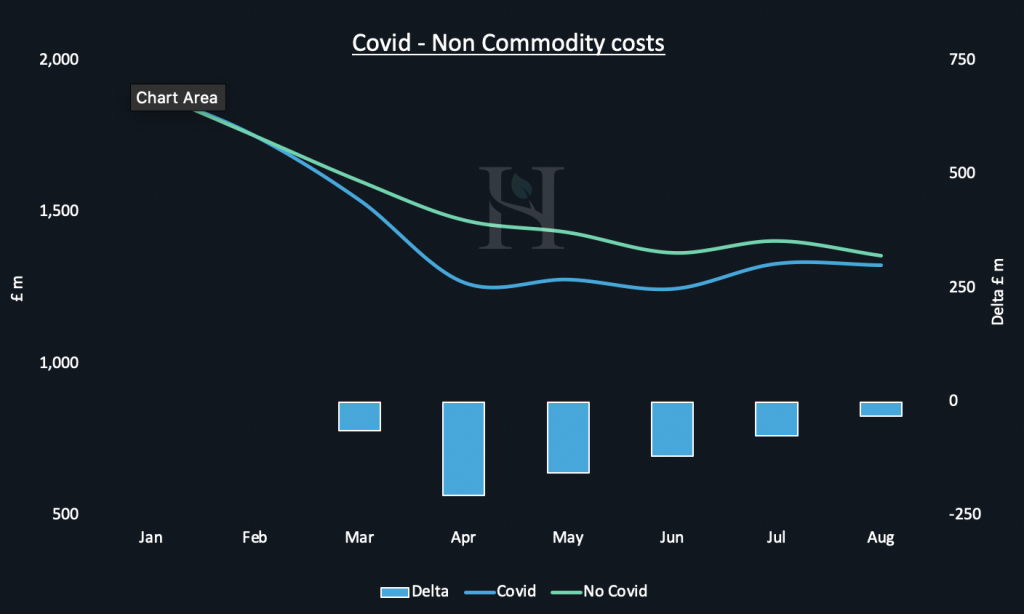

• £649m Loss of Income in Non-Commodity Power Revenues

• Power prices in April £3.30/MWh lower

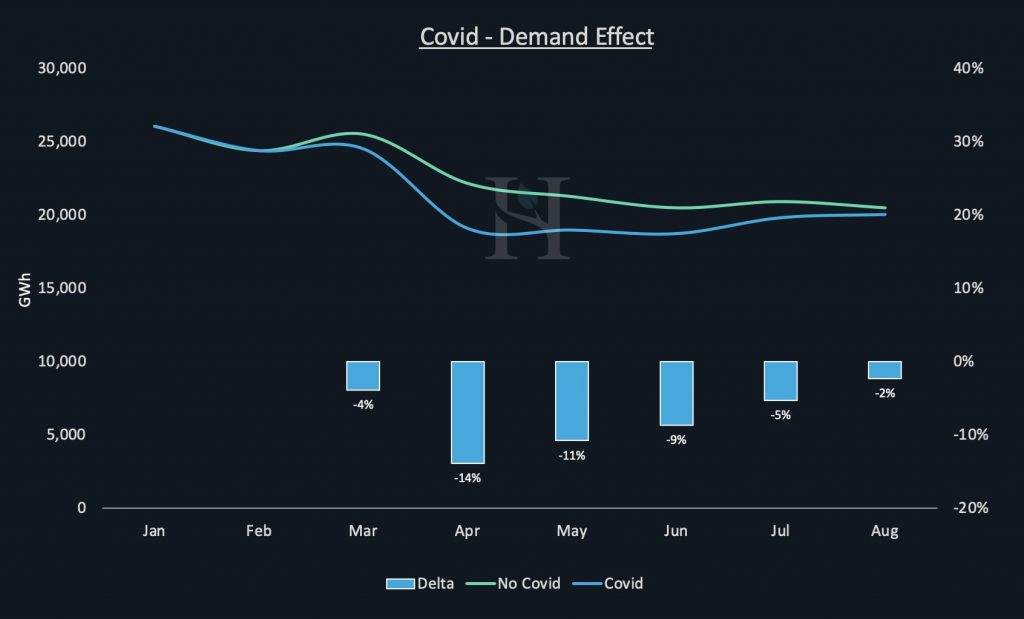

• Covid-19 Inflicted 7.5% Destruction on UK Power Demand

• Utility hedges set to lose over £35m

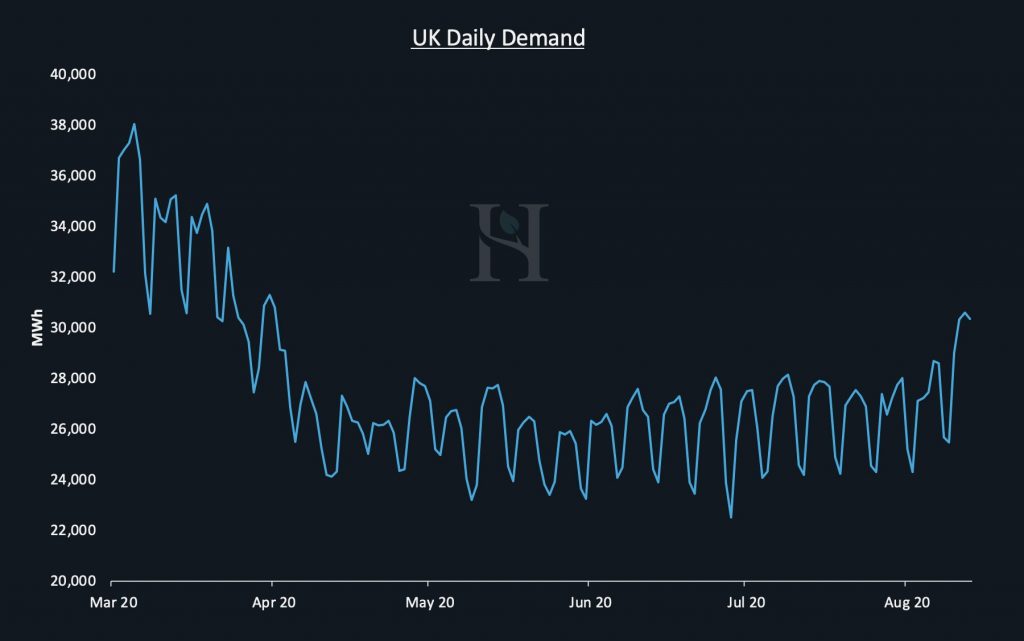

• UK Daily Demand Almost Back to Pre-Lockdown Levels

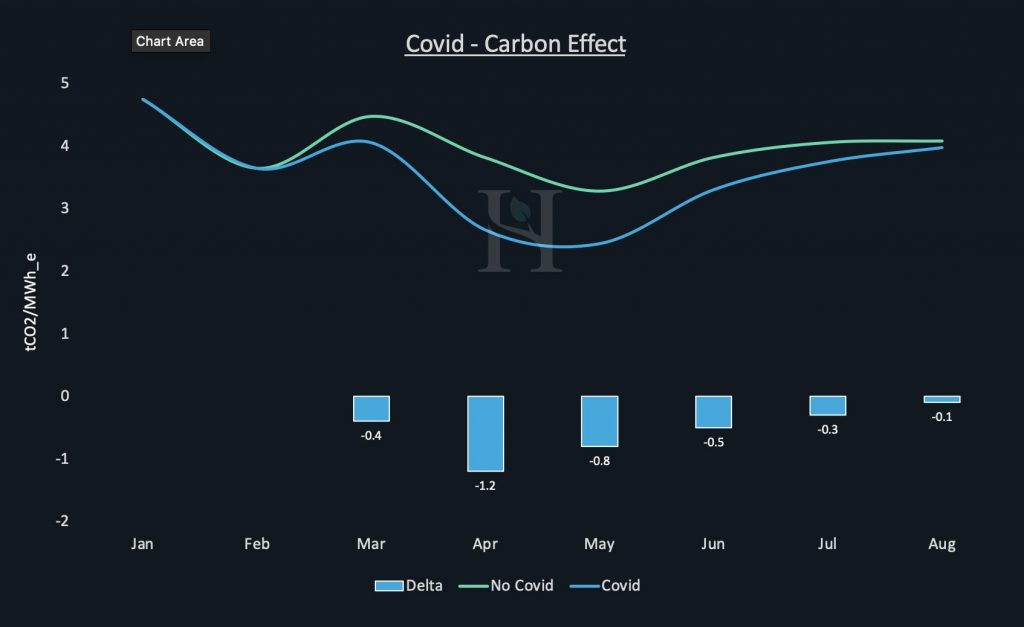

• Covid-19 Spared More than 3 Million Tons of Carbon

The Analysis

Through Hartree Solutions market-leading analysis we are able to model the UK power market as if Covid-19 and the subsequent consequences hadn’t occurred and compared that with the actual numbers recorded over the same period. For the first time, we can represent the true impact the measures taken to slow the spread of coronavirus has had on the UK power industry.

£1.1b Loss of Income in the UK Power Industry

The UK entered lockdown on March 23, and it remained fully in place throughout April before restrictions began to be eased in early May. This is borne out in each of the charts with April showing the biggest delta from normal operations, according to our modelling. April saw the UK power industry lose £353 million of revenue directly as an impact of Covid-19, with that figure tailing off to a £58 million difference this month.

Power prices in April £3.30/MWh lower

From a wholesale power price perspective, April is again the month which saw the largest impact, with UK power prices on average £3.30 per MWh lower than if Covid-19 hadn’t cut into demand. It is worth noting that the slump in actual wholesale prices continued into May to reach its nadir towards the end of that month with prices entering negative territory. Whilst Covid-19 was the driver of these negative periods, this is just a brief insight into what’s to come in the UK power markets in the next few years. As renewable build-outs continue to grow it will have an offsetting effect on demand similar to Covid-19. Even in an unsubsidised renewable market, we forecast strong renewable growth in the UK and as a result, these negative pricing periods will soon become the new normal.

Covid-19 Inflicted 7.5% Destruction on UK Power Demand

Power demand tracks economic activity and Britain’s service-oriented economy suffered more than any major European nation during the coronavirus lockdown. Gross domestic product plunged 20.4% in the second quarter, the most on record.

Turning to our own UK demand modelling, we calculate demand destruction of 14% in April with the effects slowly reducing to be just 2% this month. Overall, the average monthly drop in demand was 7.5%. While April is consistently the most extreme month, the charts also share the same parabola that sees August’s delta being lower than March, even though the lockdown only came into place at the back end of March.

Utility hedges set to lose over £35m

As shown above, demand came in significantly lower than expected which lead to lower power prices. Utilities, supplying end-users and industrials, will have pre-bought against ‘normal’ pre-covid demand levels only for their actual customer demand to come in on average 7.5% lower. The excess volumes purchased would then be sold back out to the market at these now lower pricing levels causing losses of over £35m.

UK Daily Demand Almost Back to Pre-Lockdown Levels

As we look at the UK demand in more detail, we can see that daily demand trended lower from early March to reach its lowest point in early July. Since then demand has steadily ticked up and this week it reaches its highest level since the impact of the lockdown began to be properly felt on the UK economy. These figures chime with the bulk of businesses allowed to reopen in early July and output consequently ramping up from that point.

Covid-19 Spared More than 3 Million Tons of Carbon

From an environmental view, the destruction in demand resulted in 3.35 million tons of carbon not produced by the generation of electricity that would otherwise have been emitted. April and May alone saw a reduction of 2 million tons, our Hartree analysis shows.

A look forward

While the impact of the first wave of Covid-19 looks to be easing with August showing the power market nearly back to the status quo, attention starts to turn to winter. Here, several unknowns make for an uncertain outlook amid the threat of a second wave of the coronavirus. To date, much of the demand loss has been during the morning peak between 7 am to 11 am, largely as a result of school closures. However, with schools scheduled to return in September and reports indicating limited evidence of widescale Covid-19 infections at schools, demand losses as a result of Covid-19 could well be muted by the time winter kicks in. Our in-house modelling accounts for these uncertain scenarios allowing us to price the impacts for our customer’s benefit.

Hartree Solutions through its market-leading modelling provides this edge to UK businesses via guaranteed discounted energy prices. By partnering with us, large energy users can typically save up to 30% on their bills as well as benefit from the Hartree Verified Emission Reduction scheme to further reduce their carbon footprint.

For more information on this article please

Get in Touch

Adam Lewis