On Tuesday 15th September National Grid issued only its second Capacity Mechanism (CM) warning1 indicating a lack of margin on the system whilst also publishing the probability of a blackout was 36.9%2 via its Loss of Load Probability (LoLP) calculation. (See our Market Insight covering the events of this day in detail). However, if we rewind the clock to 6th May, National Grid contracted Sizewell Nuclear power plant3 to half its generation in reaction to Covid led lower demand.

Our analysis at Hartree Solutions concludes that these actions, through higher power prices led to:

- increased costs to consumers of £72.7m,

- additional wholesale costs of £3.8m on the 15th September,

- a 24% increased risk of a blackout,

- an increase to the Reserve Scarcity Price of £1,442, and

- the issuance of a CM notice

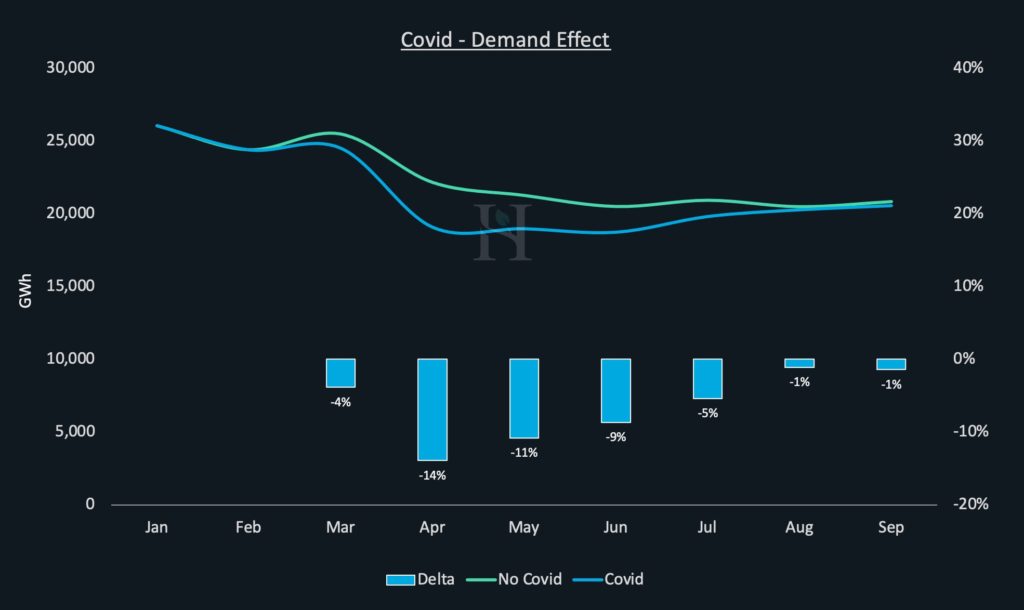

On the 6th May 2020, the market had just observed a 14% demand loss4 for UK electricity as a result of the Covid-19 lockdowns. As a result, National Grid announced it had contracted with EDF to reduce the generation of its Sizewell nuclear power plant to 50%, a reduction of 600MW, to counter periods of low demand and oversupply5. Additionally, National Grid created a new product ‘Optional Downwards Flexibility Management’ (ODFM)5 that reduces embedded generation resulting in increased demand during these challenging low demand periods.

As the summer progressed and the observed demand loss directly associated with Covid decreased from 14% to just 1% by August6, National Grid decided to extend the Sizewell contract on 6th August out to 24thSeptember7.

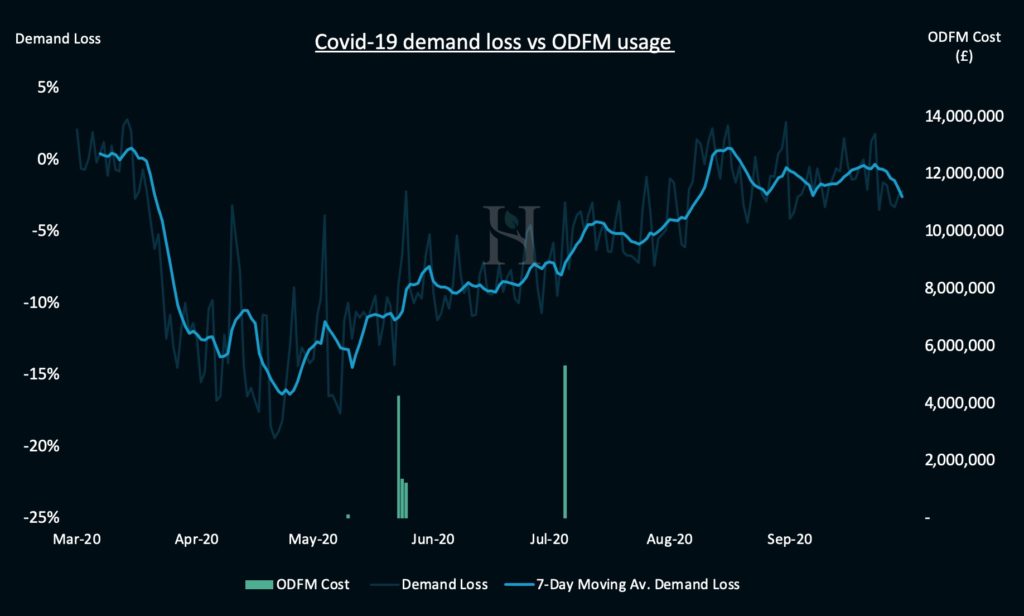

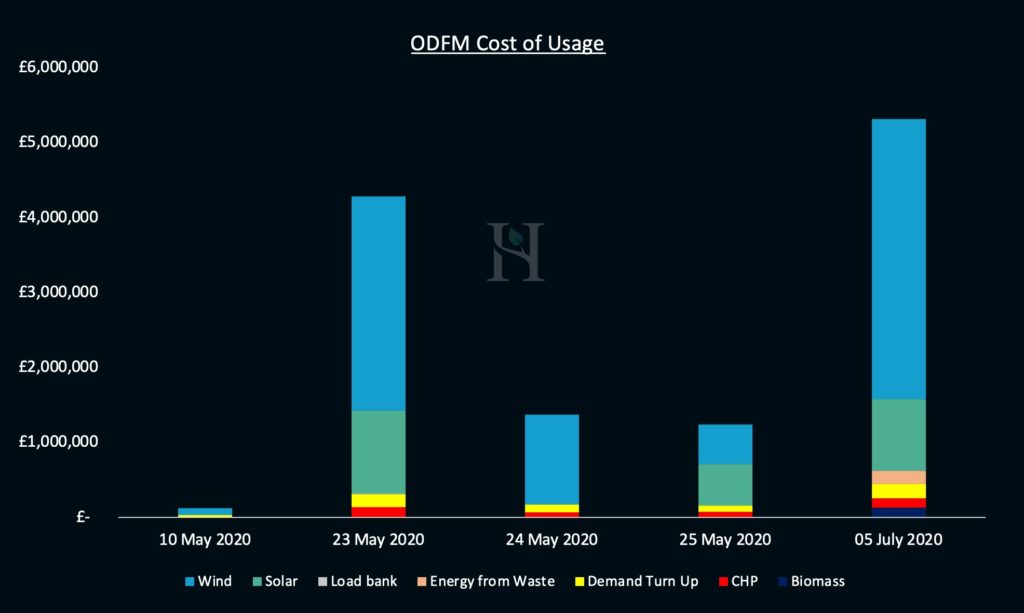

During this time, National Grid had only utilised its ODFM service a total of 5 times with the last date of usage on 5th July8, possibly an indication of the reduction of system stress from lower demand. Below we have highlighted the Covid-19 demand destruction alongside National Grids usage of ODFM. As the demand destruction eased the requirement to use such products diminished and arguably their value. As a result, some may view the decision to extend the Sizewell contract a puzzling one.

Assessing the value of such contracts is complex and requires the consideration of several factors such as the impact on market prices, the costs of balancing the system and the cost of the Sizewell contract itself. Due to lower demand and the increased oversupply of electricity generation, National Grid’s balancing actions have both increased in volume and costs9. In such low demand periods, balancing costs will have been reduced by the lower generation levels of Sizewell. The realised benefits of this can only be valued by National Grid, numbers that are not readily available at the time of publishing this Market Insight.

However, at Hartree Solutions, we use our in-house models to analyse the impact of the Sizewell contract on wholesale power prices. To do this we enabled both Sizewell units to be fully operational in our model and then compared this power price forecast with that of our base case forecast (using just one unit available as contracted by National Grid). As you would expect, removing a baseload 600MW generation unit from the market results in higher power prices. Below we express these as both a daily cost to consumers as well as the cumulative cost from 1st May to 16th September. This cumulative increase in wholesale power prices resulted in additional consumer costs of £72.7m4. (See chart ‘Cumulative Industry Costs’)

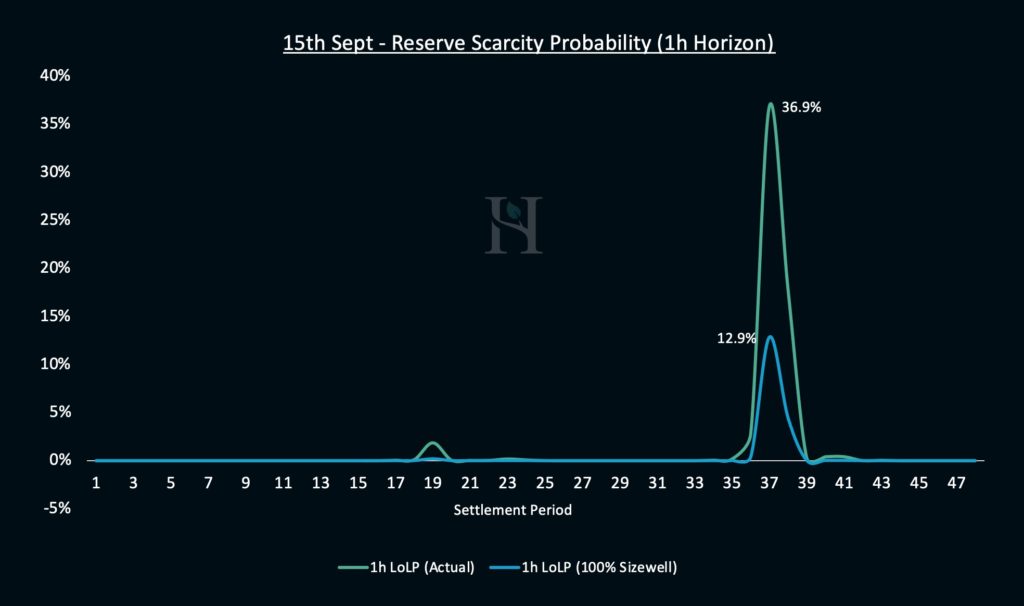

Whilst National Grid contracted Sizewell off to avoid the risk of blackouts in low demand periods, on 15thSeptember this blackout avoidance contract had the opposite effect leading to an increased risk of a blackout by 24% from 12.9% to 36.9% as the UK experienced low winds and high generation4.

The 1-hour LoLP as published by National Grid2 on this day was 36.9% at its high, representing the likelihood of blackouts. As we know, National Grid had contracted 600MW of Nuclear generation not to run during this period. The LoLP calculation is a dynamic hourly calculation. Hartree Solutions have modelled this calculation and estimate that had Sizewell not been contracted off this probability would have dropped to 12.9%, a 24% reduction of a blackout risk as demonstrated above.

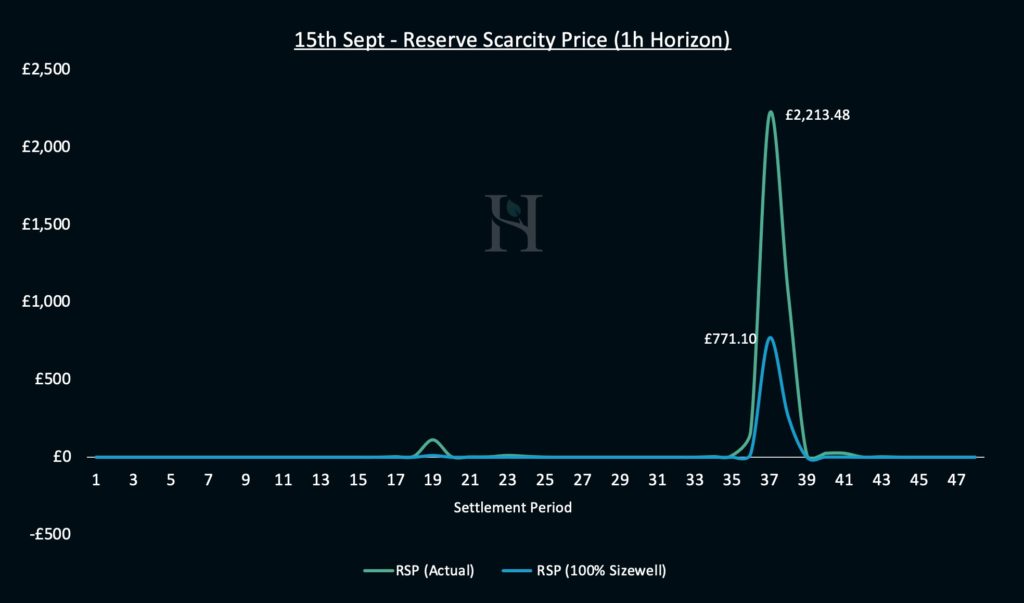

The LoLP calculation also feeds into the imbalance price calculation as it is multiplied by the Value of Loss of Load (VoLL) of £6,000 creating the Reserve Scarcity Price (RSP)10. This value was £2,213 for period 37 on 15th September. Using Hartree Solutions calculated LoLP assuming no Sizewell contract leads to a reduced RSP of £1,442 to £771 MW/h.

Further, from our modelling (as shown below), we demonstrate the market power price impact on this day from the Sizewell contract4. As a result, wholesale power prices were significantly higher leading to increased consumer costs estimated to be £3.8m.

We also analysed the rules of issuing a CM notice concerning the events of this day. Our analysis shows that had Sizewell not been contracted off no CM warning would have been issued due to the greater margin available.

This analysis demonstrates that in times of system stress, relatively small volumes and events can have a large impact on prices. To manage these risks, it is essential to have a detailed real-time understanding of the mechanisms and drivers of pricing. At Hartree Solutions, this is our day job. Using these skills, we can partner with large energy consumers to mitigate these risks for them and guarantee energy bills up to 30% lower.

Footnotes

1 National Grid CM warning message

2 National Grid LoLP message

3 National Grid Sizewell contract

4 Hartree Solutions Analysis

5 National Grid Announces new low demand tools

6 Hartree Solutions internal demand forecast accounting for expected wind and solar installations and non-Covid-19 year-on-year demand destruction

7 National Grid Extension of Sizewell contract

8 National Grid Usage of ODFM

9 Ofgem review of balancing costs summer 2020

10 Reserve Scarcity Pricing calculation

Adam Lewis