What started out a couple of months ago as a surge in prices amid low wind and concerns about storage levels has fast accelerated into a full-blown crisis with new records being set on an almost daily basis, resulting in about 2 million households seeing their energy supplier go bust and the UK government forced to step in and help out energy intensive businesses.

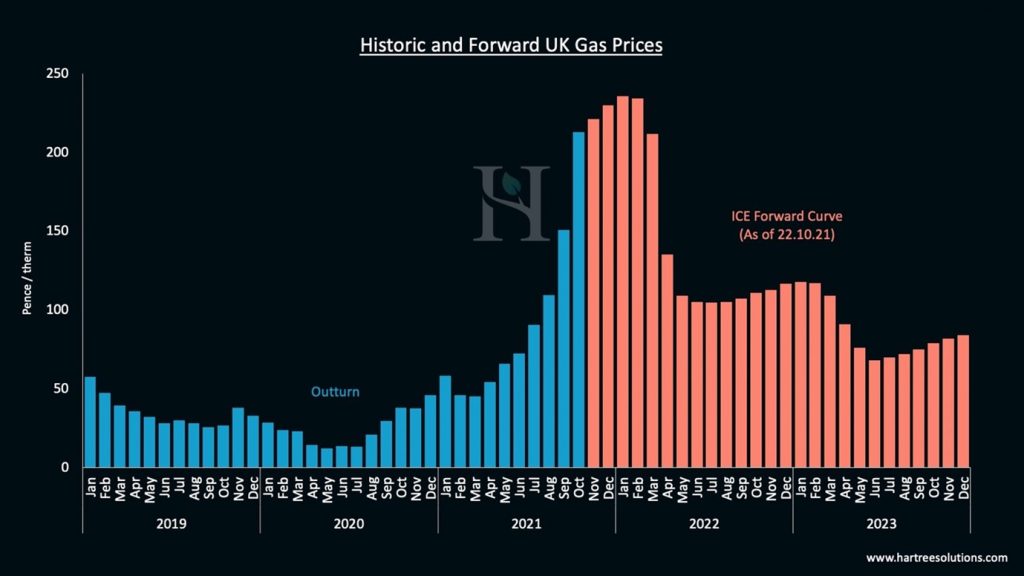

At the start of October, the UK gas price passed 400p per therm during extremely volatile trading, with intraday gains up to 39%. Although prices have dropped since the early October pinnacle, the UK’s fundamental outlook hasn’t changed. The supply/demand balance for this winter is still tight and prices are likely to remain elevated for a number of months yet.

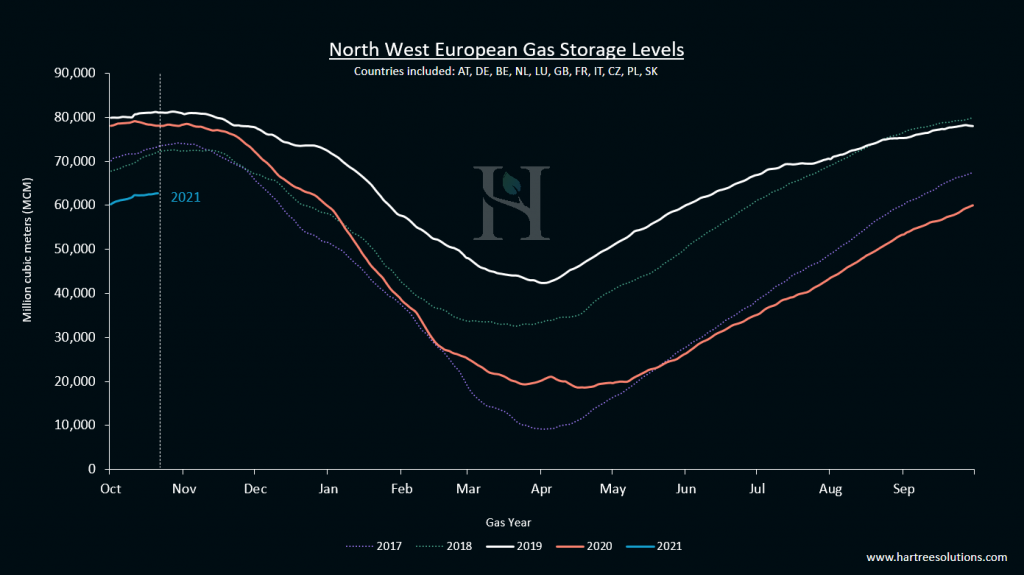

So far, the rise in wholesale prices have forced 15 suppliers of gas and electricity to UK homes go out of business with likely further casualties yet. The more recent rise of storage levels to around 77% full is, however, providing a glimmer of hope to gas balances.

While the energy price cap, which limits the rates a supplier can charge a domestic customer for their default tariffs, is protecting households, there is no such mechanism in place for businesses who have to absorb ever-higher gas and power prices into their production and manufacturing costs. For the most energy-intensive companies, this has forced them to consider whether they can continue operating in the current environment.

A prime example was fertilizer manufacturer CF Fertilisers shutting sites in September before the government agreed an exceptional 3-week arrangement with the company that allowed it to continue operating. With CF Fertilisers also the UK’s largest producer of carbon dioxide, the government went a step further and forced the CO2 industry to agree a price for CF Fertilisers’ supplies while global gas prices remain high.

This government intervention has led to other energy intensive industries, such as steel producers and paper mills, similarly calling for help to see them through this period of elevated prices.

These price surges and extremely volatility in gas and electricity prices highlight the value Hartree Solutions can offer to energy intensive businesses by developing localised generating assets such as solar, combined heat and power (CHP) or battery storage and then optimising the asset to ensure it provides security of supply and protects businesses from these wild price swings.

This gas crisis is set against the backdrop of the UK’s ambitious target to eliminate fossil fuels from electricity generation by 2035, which Prime Minister Boris Johnson announced at the start of October. With gas and coal the source of more than 36% of the UK’s electricity in 2020, the country needs to set clear policy to meet these goals. For example, in just a few months’ time the government-backed Capacity Mechanism, designed to ensure the UK’s security of supply, will likely contract new gas generators that will be providing power well past this 2035 target date.

The National Grid’s recently released Winter Outlook states that “there is sufficient generation availability and interconnector imports to meet demand” while warning the network provider may well have to issue Electricity Margin Notices (EMNs), particularly in December through to mid-January when tight margins are likely. Last winter, the Grid issued six EMNs, the first time it has had to resort to these measures since 2016, further illustrating the challenges the country faces as it transitions towards a renewable future.

One unwitting side effect of the extreme gas prices is that coal generation has become profitable again. With emitters needing to buy more carbon allowances to cover this unexpected coal usage, the cost of these permits has risen sharply too increasing the likelihood of the government being forced to involve itself in this market too.

The UK created its own Emissions Trading Scheme earlier this year, after leaving the EU ETS as a result of Brexit, if the carbon price remains high for another two months the Cost Containment Mechanism (CCM) will be triggered in December. The mechanism enables the UK ETS Authority to intervene if the average allowance price is double the average price for 3 consecutive months. The average carbon price in September was £58.36/ton, more than 10% above the threshold needed to trigger the CCM. If the average price stays above £52.88/metric ton in October and November, then the authority will consider what action to take.

With so many different strands to the energy markets and the potential for government intervention across a broad range of factors, Hartree Solutions’ 20+ years expertise in tracking and understanding energy markets along with advanced asset optimisation can help support businesses through these unprecedented, headline-making times.

Adam Lewis